Services

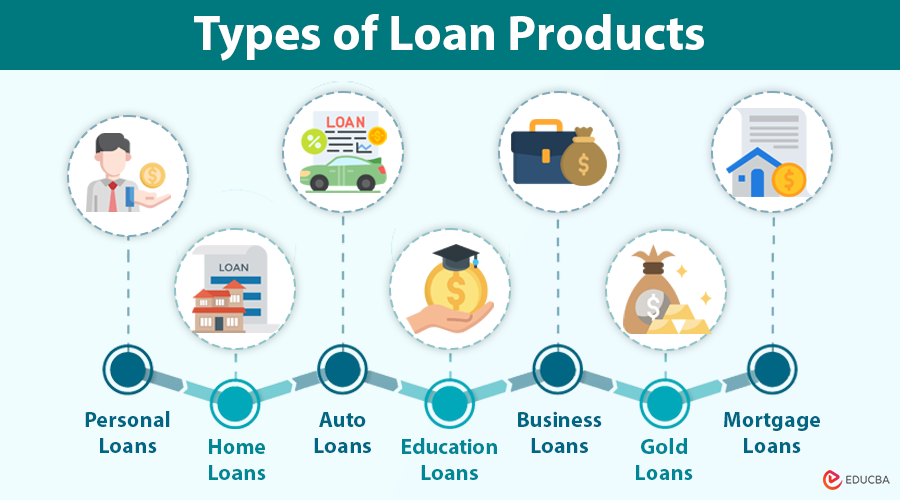

Personal Loan

A personal loan is an unsecured loan offered by banks or NBFCs to meet urgent financial needs like medical bills, weddings, or travel, without collateral, with flexible tenure and quick disbursal based on eligibility.

Document Requirements

- Duly filled loan application form

- Identity proof (Aadhaar, PAN, Passport, Voter ID)

- Address proof (Aadhaar, Utility Bills, Rent Agreement)

- Income proof (Salary slips, ITRs, Bank statements)

- Employment or Business proof (Offer Letter, Business Registration)

- Property documents (for secured loans)

- Passport size photographs

Home Loan

A home loan is a secured loan provided by banks or financial institutions to help individuals purchase, construct, or renovate a house. It offers long repayment tenure, competitive interest rates, and tax benefits.

Document Requirements

- Duly filled loan application form

- Identity proof (Aadhaar, PAN, Passport, Voter ID)

- Address proof (Aadhaar, Utility Bills, Rent Agreement)

- Income proof (Salary slips, ITRs, Bank statements)

- Employment or Business proof (Offer Letter, Business Registration)

- Property documents (for secured loans)

- Passport size photographs

Education Loan

An education loan helps students finance higher studies in India or abroad. It covers tuition, accommodation, travel, and other expenses, with flexible repayment options and moratorium periods until course completion or job acquisition.

Document Requirements

- Duly filled loan application form

- Identity proof (Aadhaar, PAN, Passport, Voter ID)

- Address proof (Aadhaar, Utility Bills, Rent Agreement)

- Income proof (Salary slips, ITRs, Bank statements)

- Employment or Business proof (Offer Letter, Business Registration)

- Property documents (for secured loans)

- Passport size photographs

Vehicle Loan

A vehicle loan is a secured loan offered to purchase a new or used car or two-wheeler. It comes with fixed or flexible EMIs, competitive interest rates, and quick approval based on eligibility.

Document Requirements

- Duly filled loan application form

- Identity proof (Aadhaar, PAN, Passport, Voter ID)

- Address proof (Aadhaar, Utility Bills, Rent Agreement)

- Income proof (Salary slips, ITRs, Bank statements)

- Employment or Business proof (Offer Letter, Business Registration)

- Property documents (for secured loans)

- Passport size photographs

Business Loan

A business loan provides financial support to startups, SMEs, and large enterprises for expansion, working capital, or equipment. Offered by banks/NBFCs, it includes flexible repayment terms, competitive interest rates, and minimal documentation.

Document Requirements

- Duly filled loan application form

- Identity proof (Aadhaar, PAN, Passport, Voter ID)

- Address proof (Aadhaar, Utility Bills, Rent Agreement)

- Income proof (Salary slips, ITRs, Bank statements)

- Employment or Business proof (Offer Letter, Business Registration)

- Property documents (for secured loans)

- Passport size photographs

Loan Against Property (LAP)

Loan Against Property (LAP) is a secured loan where borrowers pledge residential, commercial, or industrial property as collateral. It offers high loan amounts, lower interest rates, and longer tenure for personal or business needs.

Document Requirements

- Duly filled loan application form

- Identity proof (Aadhaar, PAN, Passport, Voter ID)

- Address proof (Aadhaar, Utility Bills, Rent Agreement)

- Income proof (Salary slips, ITRs, Bank statements)

- Employment or Business proof (Offer Letter, Business Registration)

- Property documents (for secured loans)

- Passport size photographs

Gold Loan

A gold loan is a secured loan where individuals pledge gold ornaments or coins as collateral. It offers instant funds, minimal documentation, flexible repayment options, and is ideal for short-term financial needs or emergencies.

Document Requirements

- Duly filled loan application form

- Identity proof (Aadhaar, PAN, Passport, Voter ID)

- Address proof (Aadhaar, Utility Bills, Rent Agreement)

- Income proof (Salary slips, ITRs, Bank statements)

- Employment or Business proof (Offer Letter, Business Registration)

- Property documents (for secured loans)

- Passport size photographs

Agriculture Loan

An agriculture loan is provided to farmers for crop production, equipment purchase, irrigation, or land development. It offers subsidized interest rates, flexible repayment terms, and supports rural livelihoods through government-backed or bank-issued credit facilities.

Document Requirements

- Duly filled loan application form

- Identity proof (Aadhaar, PAN, Passport, Voter ID)

- Address proof (Aadhaar, Utility Bills, Rent Agreement)

- Income proof (Salary slips, ITRs, Bank statements)

- Employment or Business proof (Offer Letter, Business Registration)

- Property documents (for secured loans)

- Passport size photographs

Top-Up Loan (on Home/Personal Loans)

A Top-Up Loan is an additional loan offered on an existing home or personal loan. It provides extra funds at lower interest rates with minimal documentation, useful for renovation, medical needs, or personal expenses.

Document Requirements

- Duly filled loan application form

- Identity proof (Aadhaar, PAN, Passport, Voter ID)

- Address proof (Aadhaar, Utility Bills, Rent Agreement)

- Income proof (Salary slips, ITRs, Bank statements)

- Employment or Business proof (Offer Letter, Business Registration)

- Property documents (for secured loans)

- Passport size photographs